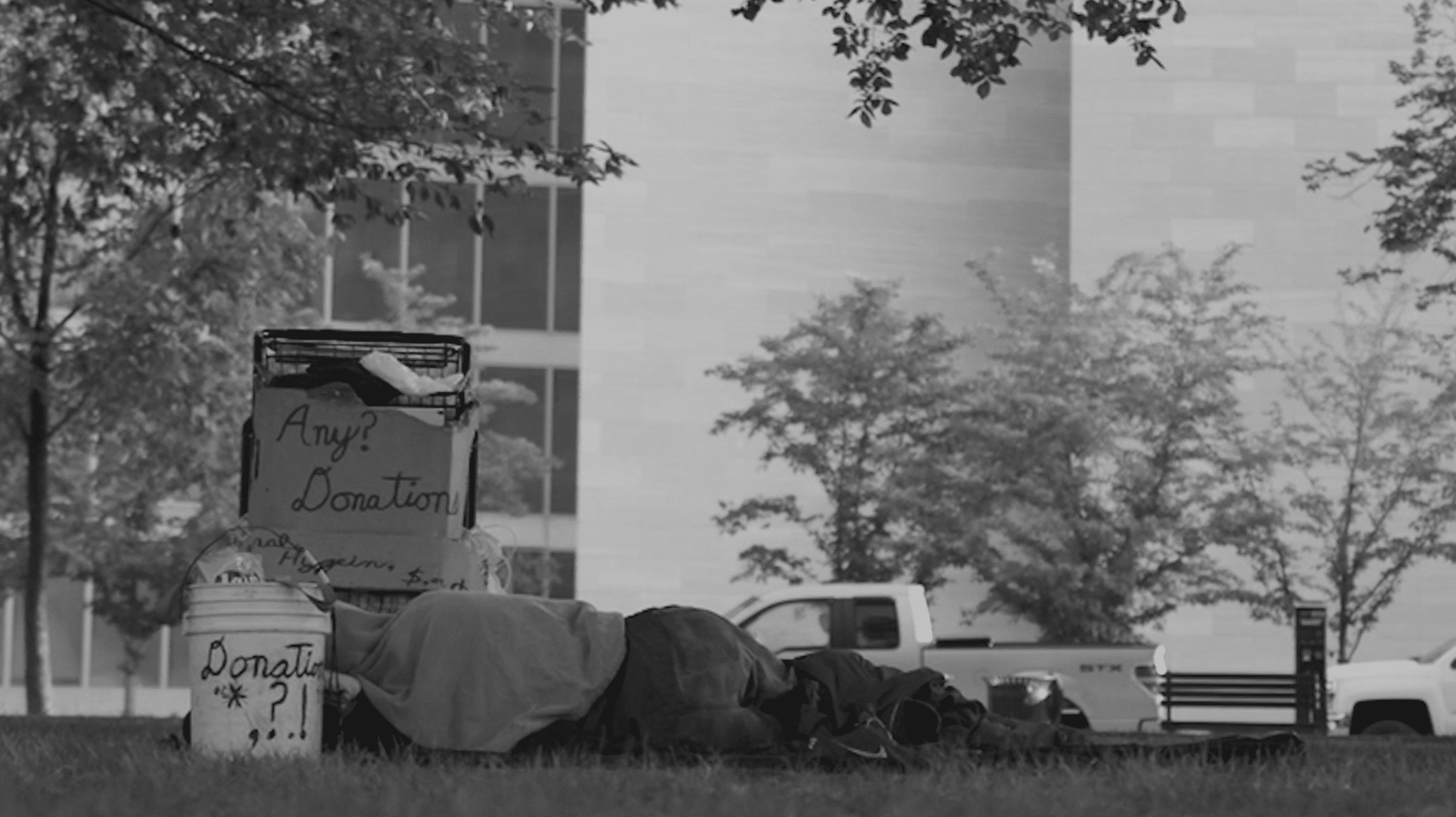

Your Gift Empowers Financial Stability for a Local Family

Help support us by making a donation.

FEATURED STORIES

Resilience in the Face of Adversity – Meet Kavonnie Hines

“It’s like it has to get worse before it possibly gets better.”- Kavonnie Hines ...

Once A Participant, Tamra Holmes Returns To Project Homeless Connect As A Volunteer

After the sudden death of her 14-year-old daughter’s godmother, Tamra Holmes had nowhere left to...

Samira’s Story – United Way NCA Helps Bridge the Digital Divide

Imagine being a student in today’s digital world with no access to a laptop or...

How Project Community Connect is Changing the Narrative Around Unhoused and ALICE Communities

For many National Capital Area residents living one paycheck away from experiencing homelessness, one event can turn their entire lives upside down. For community member Aimee*, her journey to becoming..

Kit Distribution Provides Much Needed Support to Montgomery County Middle School Students

Through the generous support and contributions from United Way of the National Capital Area’s local partners, 6,531 hygiene, cold weather and healthy snack kits were distributed across the DC region during the..

United Way NCA’s VITA program supported over 8,000 in 2021 – returning $11.4M back into the hands of families

The Volunteer Income Tax Assistance (VITA) Program delivers one of...

FAQs About Donating to United Way NCA

Yes. The security and confidentiality of your information is our highest priority. We use industry-standard SSL (secure socket layer) technology to protect your information and provide a safe and secure environment for online nonprofit donations.. We will not sell, trade or share your personal information with any person or entity outside of United Way of the National Capital Area without receiving your specific permission to do so.

United Way of the National Capital Area is a 501(c)3 tax-exempt organization and your donation is tax-deductible. To claim a charitable donation as a deduction on your U.S. taxes, please keep your email receipt as your official donation documentation.

Yes, when you donate to United Way NCA, a donation receipt will be emailed to the address you provide during the process.

Yes. Although we encourage donating online, you may also send us a donation via check by mailing it to:

United Way of the National Capital Area

Department 0751

Washington, DC 20073-0751

For questions on donating over the phone, please call us at 202.488.2038. We strongly encourage donating through our online portal as it is safe, secure and quick.

Yes. The IRA charitable rollover is a great way for you to make a gift to support United Way of the National Capital Area. The IRA rollover allows donors 70.5 years or older to transfer up to $100,000 directly from their IRA to United Way NCA on an annual basis. An IRA rollover gift is a tax-exempt distribution. Qualifying individuals can make charitable gifts using pre-tax IRA assets rather than taking a distribution, paying income taxes and using after tax assets to make a charitable gift. An IRA rollover gift can be used to meet all or part of an IRA’s annual required minimum distribution. Learn more at unitedwaynca.org/take-action/donate/planned-giving.

Yes, to cancel your recurring donation, please contact us at 202.488.2038 or email philanthropy@uwnca.org.

To learn more about the variety of ways you can donate to United Way of the National Capital Area, please visit unitedwaynca.org/take-action/donate.

If you’d like to speak to someone before donating, please call 202-488-2038 or email philanthropy@uwnca.org.

If you would like to give to United Way NCA by mail, please send checks to:

United Way of the National Capital Area

Department 0751

Washington, DC 20073-0751